The Two Ways To Calculate Europe VAT

- Amazon is offering a VAT Calculation/VAT invoicing Service whereby they take charge of all VAT calculations at the time of sale

- Amazon will send SellerLegend the calculated VAT, which can then be shown in the Profit And Loss Statement

- If you are not using the Amazon service, you can instruct SellerLegend to calculate VAT instead

- Please note that SellerLegend only provides a VAT calculation service but does not offer a VAT invoicing service

- When SellerLegend calculates VAT, it can be shown in the Profit and Loss Statement

- Which VAT calculation service input is used in the Profit and Loss Statement depends on the settings described below

The Different Ways To Show Europe VAT In SellerLegend

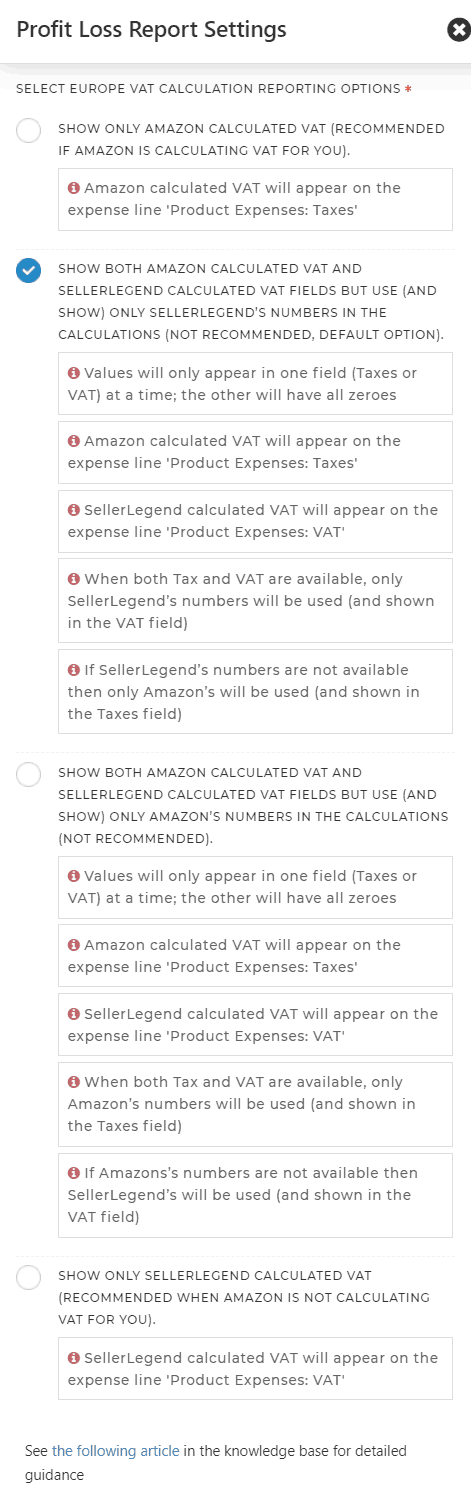

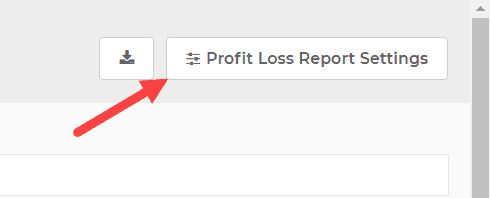

- In the P&L screen, you will see a Settings button at the top of the screen

- Clicking on that button, and scrolling down below the PPC settings, will offer you 4 options which are described in detail below:

- SHOW ONLY AMAZON CALCULATED VAT (RECOMMENDED IF AMAZON IS CALCULATING VAT FOR YOU).

- Amazon calculated VAT will appear on the expense line ‘Product Expenses: Taxes’

- SHOW BOTH AMAZON CALCULATED VAT AND SELLERLEGEND CALCULATED VAT FIELDS BUT USE (AND SHOW) ONLY SELLERLEGEND’S NUMBERS IN THE CALCULATIONS (NOT RECOMMENDED, DEFAULT OPTION).

- Values will only appear in one field (Taxes or VAT) at a time; the other will have all zeroes

- Amazon calculated VAT will appear on the expense line ‘Product Expenses: Taxes’

- SellerLegend calculated vat will appear on the expense line ‘Product Expenses: VAT’

- When Both Tax and VAT are available, only SellerLegend’s numbers will be used (and shown in the VAT field)

- If SellerLegend’s numbers are not available then only Amazon’s will be used (and shown in the taxes field)

- SHOW BOTH AMAZON CALCULATED VAT AND SELLERLEGEND CALCULATED VAT FIELDS BUT USE (AND SHOW) ONLY AMAZON’S NUMBERS IN THE CALCULATIONS (NOT RECOMMENDED).

- Values will only appear in one field (Taxes or VAT) at a time; the other will have all zeroes

- Amazon calculated vat will appear on the expense line ‘Product Expenses: Taxes’

- SellerLegend’s calculated vat will appear on the expense line ‘Product Expenses: VAT’

- When Both Tax and VAT are available, only Amazon’s numbers will be used (and shown in the taxes field)

- If Amazons’ numbers are not available then SellerLegend’s will be used (and shown in the VAT field)

- SHOW ONLY SELLERLEGEND CALCULATED VAT (RECOMMENDED WHEN AMAZON IS NOT CALCULATING VAT FOR YOU).

- SellerLegend calculated VAT will appear on the expense line ‘Product Expenses: VAT’

- Learn how to define the Europe VAT rates in SellerLegend here

- SHOW ONLY AMAZON CALCULATED VAT (RECOMMENDED IF AMAZON IS CALCULATING VAT FOR YOU).