How To Get Here?

- From the Menu

- Settings –>Account Settings–> Europe VAT

What is it for?

- To indicate your VAT registration states for each European marketplace you trade in

- To set/override the Marketplace default VAT rate or reduced VAT rate

- To record your date of VAT registration or VAT de-registration

- We cater for the following use cases:

- A seller is not VAT registered for a period of time when just starting a new business

- A seller has exceeded the VAT threshold, registers for VAT and starts charging VAT from the date of registration

- A seller changes from the Flat VAT Rate Scheme to the Standard VAT Rate Scheme or vice-versa

- A seller falls below the VAT thresholds and ceases to charge VAT and deregisters for VAT

- The tax authorities change their VAT rate (heard the one about Brexit?)

Tips And Tricks!

- You can override the default Marketplace VAT rate at the individual product level.

- This VAT screen will be empty UNLESS the Amazon account you have selected includes a Europe Marketplace

- Unless you have marked a marketplace as being registered for VAT, the VAT calculation will not kick in and VAT amounts will be zero

- If you have defined a VAT rate at the product level but the VAT is not being calculated, it is very likely due to your failing to indicate that the marketplace is VAT registered!

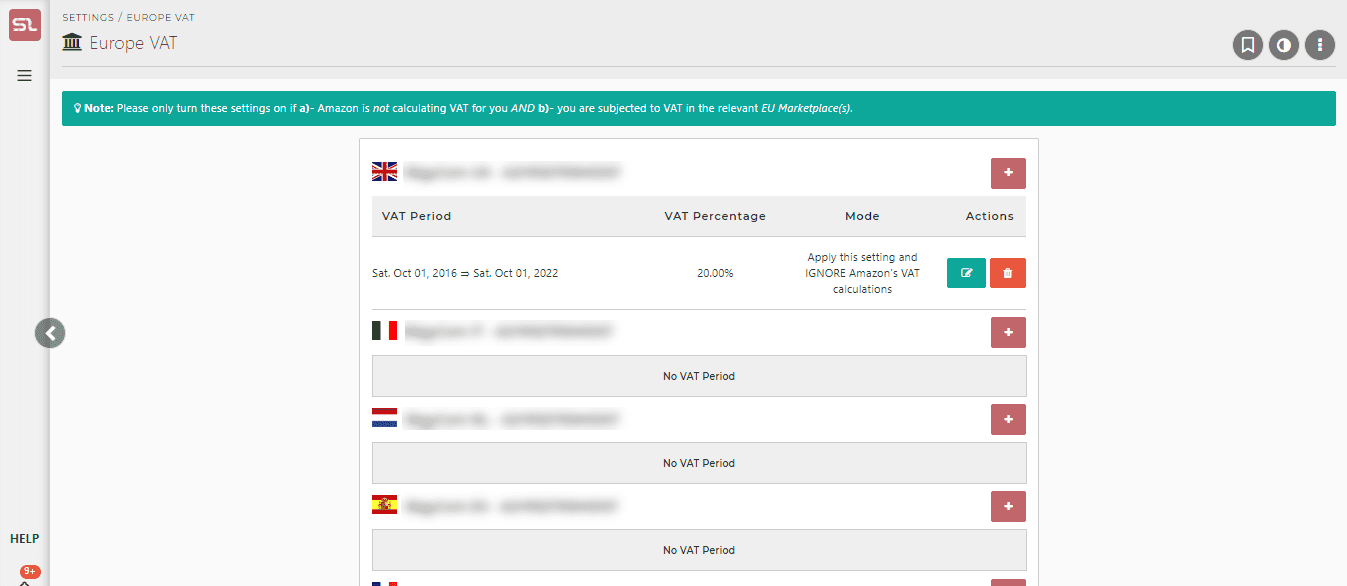

Screen Print

Content

(*) denotes features not yet implemented at the time of writing

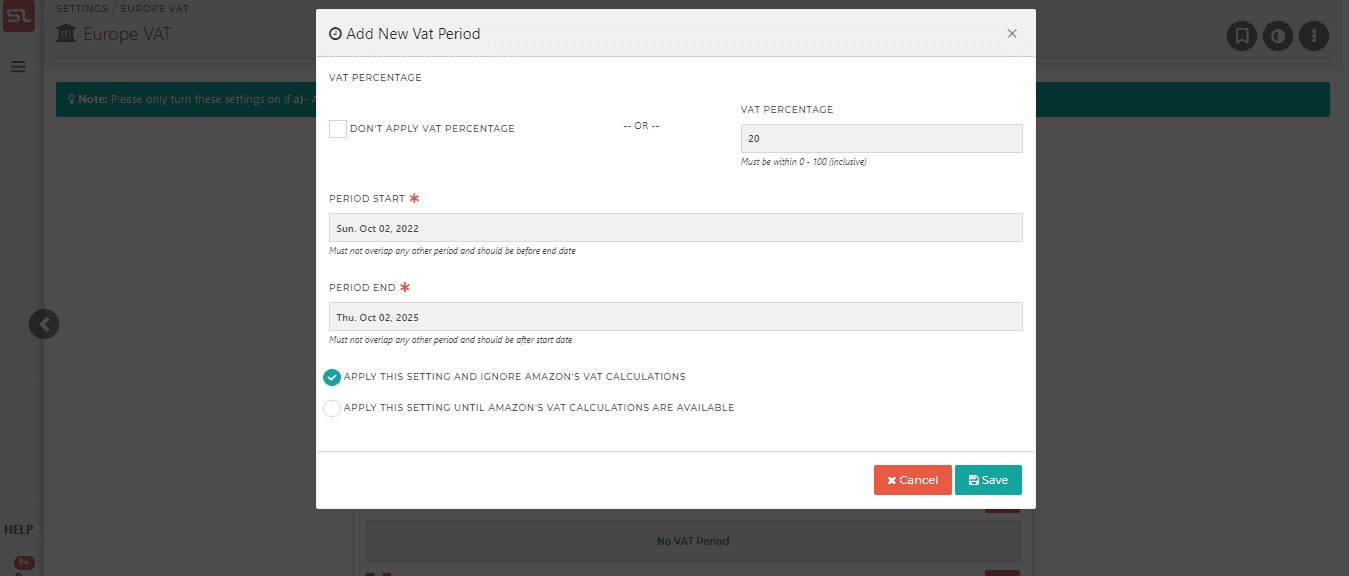

- To start entering a VAT period, click on the + button which is the Add New Vat Period button

- This will bring up the New Vat Period entry screen (the second screenshot above)

- Enter the From-To date of a specific VAT period, as well as the rate

- Period-based VAT behaves like period-based COGS, whereby a specific VAT rate is applied to the orders received between the two boundary dates specified in the settings.

- This article describes the VAT settings at the level of the marketplace as a whole, but of course, you can also define a period-based VAT rate at an individual product level, which then overrides the marketplace VAT rate.

- The marketplace and product level date ranges are independent. This provides the added flexibility to be able to assign overlapping date ranges at the product level. In essence, the date ranges at product level trump the date ranges at the marketplace level.

- The above example shows period between 10 Sep 15 to 10 Oct 16 where there was no VAT charged, followed by a period between 11 Oct 16 and 6 Nov 17 where a flat rate of 12% was charged, followed by the current period of 7 Nov 17 to 6 Dec 2020 with a standard VAT rate of 20%.

Should I Use SellerLegend VAT (known as Internal Tax/VAT in SL screens) or Amazon VAT (known as Reported Tax in SL screens)?

- You have the option to use either SellerLegend calculated VAT called “Internal Tax/VAT”, or Amazon provided VAT called “Reported Tax/VAT”)

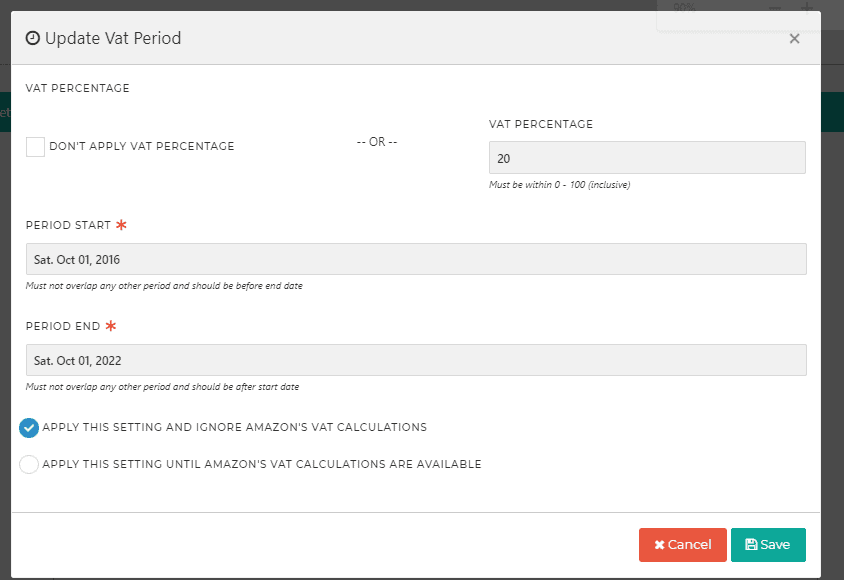

- When editing a VAT period, you will see two options:

- 1) APPLY THIS SETTING AND IGNORE AMAZON’S VAT CALCULATIONS

- With this setting, Amazon’s Reported Tax will not be used in any of the calculations, and only the tax set by the user for the VAT time period will be used.

- 2) APPLY THIS SETTING UNTIL AMAZON’S VAT CALCULATIONS ARE AVAILABLE

- Choosing this option will make the system use SellerLegend set Internal Tax only until Amazon’s VAT is available.

- Once Amazon’s Reported Tax becomes available, Internal Tax is ignored (the values are still there under its respective column), and Reported Tax is used for calculations.

- 1) APPLY THIS SETTING AND IGNORE AMAZON’S VAT CALCULATIONS

- Depending on how you wish to see VAT calculations, you may choose either option.

- If you wish to see a set rate applied to all orders, you can choose first option.

- And if you want to see VAT still calculated while Amazon hasn’t reported it (for instance, in case of pending orders), you may choose the second option.

- These options are available both when adding a new VAT period, and editing VAT periods.

- The chosen option appears under the column called “Mode”.

- Click on the green Edit button under Actions column to open the Edit VAT Period modal.

- When you select an option, it will take a different duration for changes to take on different screens.

- 15 – 20 mins for Orders

- 30 – 45 mins for Dashboards

- 45 – 60 mins for Profit & Loss report

- It may take a little longer (additional ~15 minutes) for unusually large accounts.

Conclusion

- The Product List and Product Financial Data (found on the Product Dashboard) widget will be using VAT in profit calculation.

- And on all other places, SL-VAT will be temporarily used until amazon-taxes arrive (in case of pending orders).